ITS Logistics November Port Rail Ramp Index: Port Operations Normalize as Industry Awaits Key Regulatory Updates

-- Declining import and export volumes reflect ongoing uncertainty, but rapid regulatory change could drastically turn the tide for the North American supply chain --

RENO, Nev., Nov. 13, 2025 (GLOBE NEWSWIRE) -- ITS Logistics, one of North America’s fastest-growing third-party logistics providers, today released its November forecast in the ITS Logistics U.S. Port/Rail Ramp Freight Index. This month, the index confirms a continued decline of both import and export volumes, which, while hindering overall economic activity, has allowed for port and rail congestion to alleviate. As port activity normalizes, multiple sectors within the domestic supply chain are experiencing heightened uncertainty as rapid regulatory change affects tariffs, English language proficiency enforcement, and non-domiciled trucking capacity.

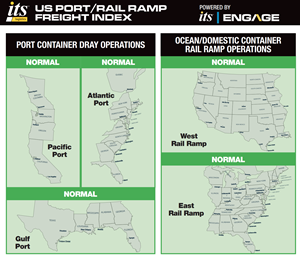

“With volume decreases, port, terminal, and ocean carrier operations remain at normal levels and should remain so through November,” explained Paul Brashier, Vice President of Global Supply Chain for ITS Logistics. “However, there are some items we are keeping a close eye on that could drastically change the landscape in North American port and ramp operations.”

U.S. container imports totaled 2,306,687 Twenty-foot Equivalent Units (TEUs) for the month of October, down 7.5% compared to 2024. While the month-over-month decrease was a marginal 0.1%, the decrease represents a divergence from typical seasonal trends, reflecting continued shipper hesitancy and a reliance on frontloaded inventory.

Despite overall decline, China-origin imports grew for the time since August, leading modest volume gains from top U.S. trading partners with a 5.4% month-over-month increase. The past several months have seen a turbulent series of trade discussions between President Donald Trump and President Xi Jinping, which recently concluded with President Trump agreeing to cut fentanyl-linked tariffs on Beijing, bringing overall duties on Chinese goods to 47%. And on Monday, both the U.S. and China announced a one-year suspension of port call fees, a move that many argued would not only increase import costs but severely impact secondary ports across the country.

Tariff uncertainty continues to be a primary driver of depressed import activity, according to industry analysts. On November 5, the Supreme Court heard the first oral arguments in the Trump Administration’s tariffs case, marking a new and contentious chapter. If the Supreme Court finds President Trump’s tariffs were enacted illegally, it would offer immediate relief for shippers while also opening the door for challenges and questions related to refunding the roughly $1 trillion dollars paid by importers since April. The administration says it is already exploring alternative routes for enforcing import duties in the event the ruling is overturned. For now, both shippers and consumers remain cautious and purposeful in their holiday spending. Holiday shoppers are expecting to spend 10% less than last year, per Deloitte’s 2025 Holiday Retail Survey.

Outside the ports, the trucking market is enduring its own legislative limbo as states react to evolving legislation surrounding non-domiciled drivers and English language proficiency (ELP) requirements. Following the Federal Motor Carrier Safety Administration’s (FMCSA) September announcement freezing the issuance and renewal of non-domiciled CDLs, state agencies, shippers, carriers, and intermediaries have scrambled to understand expectations in remaining compliant, as well as how the ruling would impact overall capacity in the market. This week, however, an Appeals Court has temporarily blocked the enforcement of this ruling, citing a failure to follow proper procedure. With the administrative stay in place indefinitely, state agencies may continue issuing and renewing non-domiciled commercial driver’s licenses to non-citizens. The ruling does not, however, pause enforcement of renewed English language proficiency (ELP) requirements, which have been heavily enforced through roadside compliance checks since July.

“It is estimated that as many as 600,000 drivers could be removed from the U.S. driver ecosystem due to non-domiciled drivers and English language proficiency (ELP) enforcement,” Brashier continued. “This, in addition to the acceleration of trucking companies exiting the market, could create trucking capacity issues for most shippers. It is a situation we are monitoring closely.”

ITS Logistics offers a full suite of network transportation solutions across North America and distribution and fulfillment services to 95% of the US population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, LTL, and outbound small parcel.

The ITS Logistics U.S. Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full, comprehensive copy of the index with expected forecasts for the US port and rail ramps.

About ITS Logistics

ITS Logistics is one of North America's fastest-growing, asset-based modern 3PLs, providing solutions for the industry’s most complicated supply chain challenges. With a people-first culture committed to excellence, the company relentlessly strives to deliver unmatched value through best-in-class service, expertise, and innovation. The ITS Logistics portfolio features North America's #18 asset-lite freight brokerage, a top drayage and intermodal provider, an asset-based dedicated fleet, an innovative cloud-based technology ecosystem, and a nationwide distribution and fulfillment network.

Media Contact:

Amber Good

LeadCoverage

amber@leadcoverage.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/41e3b48b-43b4-4b16-9268-c261133da2b4

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.